Sagicor Select Funds Manufacturing and Distribution IPO Frequently Asked Questions

With the opening day for the Sagicor Select Funds Manufacturing and Distribution (SelectMD) IPO just around the corner, we wanted to ensure you are prepared to invest! Here are answers to some of our most frequently asked questions, to help you make an informed decision.

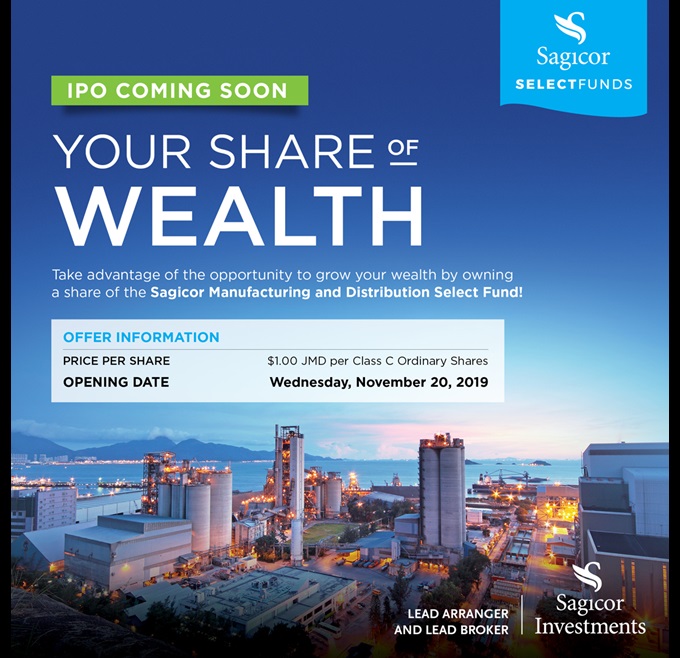

Before we dive into the questions however, let's remember the key facts, the offer information. The Sagicor Select Funds Manufacturing and Distribution IPO opens on Wednesday November 20, 2019. The price per share is $1.00 JMD per Class C Ordinary Share, with a minimum purchase of 1,000 shares.

In addition, to serve you better Sagicor Investments has opened an IPO Hub for applicants in the corporate area. Visit the IPO Hub at 6 Dumfries Road, Kingston 5 to open new stockbrokerage accounts and/or to apply for the IPO. The Hub will be open from November 12-20, 2019 from 8:30am- 3:00pm Monday to Thursday and 8:30am - 4:00pm on Friday. Please note, new stockbrokerage accounts will not be opened from November 20 to December 3, so visit the Hub to be prepared for opening day. For persons outside of the corporate area, applications can be submitted at any Sagicor Investments location.

Now let's get into the frequently asked questions:

- What is Sagicor Select Funds Limited?

Sagicor Select Funds Limited is a public company which has the primary purpose of trading in securities listed on recognized exchanges. The Company is comprised of five (5) classes of shares; with a management share class and the remaining four classes, each representing a separate fund within the Company.

- What is Sagicor Select Manufacturing and Distribution Fund?

The Sagicor Select Manufacturing and Distribution Fund represent one of the classes of ordinary shares of Sagicor Select Funds Limited. Specifically, it represents Class C shares. It is a Listed Equity Fund (LEF) that will primarily own manufacturing and distribution stocks listed on the Jamaica Stock Exchange (JSE).

- What is a Listed Equity Fund (LEF)?

A Listed Equity Fund is a type of fund that owns a pool of assets and divides ownership of those assets into shares that are listed on an exchange. The pool of assets owned by the fund can be shares of stocks, bonds, oil futures, gold bullion, foreign currency, etc. In this particular case it is shares in manufacturing and distribution companies listed on the JSE.

- How does a Listed Equity Fund (LEF) work?

The LEF will purchase assets / securities listed on a recognized exchange. The value of the fund will depend on the price performance of the securities held. As the price of the assets held increases / decreases, the value of the LEF will increase / decrease.

- What are the assets that will comprise the Sagicor Select Manufacturing and Distribution Fund?

The underlying assets will be manufacturing and distribution stocks that currently trade on the Main and Junior Markets of the JSE. Currently there are 30 companies listed on the JSE that are classified in the Manufacturing and Distribution sector.

- How do investors benefit from a LEF?

Investors will benefit from diversification, exposure to large firms listed on the JSE, possible price appreciation of the shares and potential dividend payments.

- What is the objective of the Sagicor Select Manufacturing and Distribution Fund (SMDF)?

Sagicor Select Manufacturing and Distribution Fund aims to provide precise exposure to price and yield performance of manufacturing and distribution sector companies that are listed on the JSE. SMDF is expected to track the JSE Manufacturing and Distribution Index, which is an index established by the Jamaica Stock Exchange.

- What is the JSE Manufacturing and Distribution Index?

The JSE Manufacturing and Distribution Index will track the performance of manufacturing and distribution companies, which includes companies that produce and/or distribute food products, construction inputs, office equipment, pharmaceuticals, beverages, household products that are listed on both the Main Market and Junior Market and trade in Jamaican dollars. The JSE introduced the JSE Manufacturing and Distribution Index on Tuesday, October 1, 2019, and is the JSE’s second sector Index.

- How will Sagicor Select Manufacturing and Distribution Fund track the JSE Manufacturing and Distribution Index?

The Sagicor Select Manufacturing and Distribution Fund will invest in a representative sample of securities included in the JSE Manufacturing and Distribution Index and collectively have an investment profile similar to the Index.

- Will the Sagicor Select Funds Limited Class C Shares be listed on the Jamaica Stock Exchange?

Sagicor Select Funds Limited has recently published the Initial Public Offer (IPO) prospectus to the public. The offer is scheduled to open on November 20, 2019 and close on December 4, 2019. Post the closure, the Company intends to apply to the JSE for the Class C ordinary shares of Sagicor Select Funds Limited to be listed on the Main Market of the JSE. The Class C Shares will represent the Sagicor Select Manufacturing and Distribution Fund.