About Sagicor Wealth Management

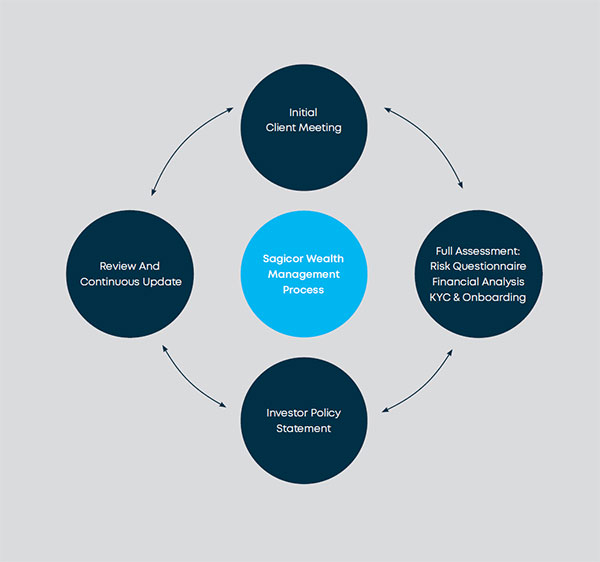

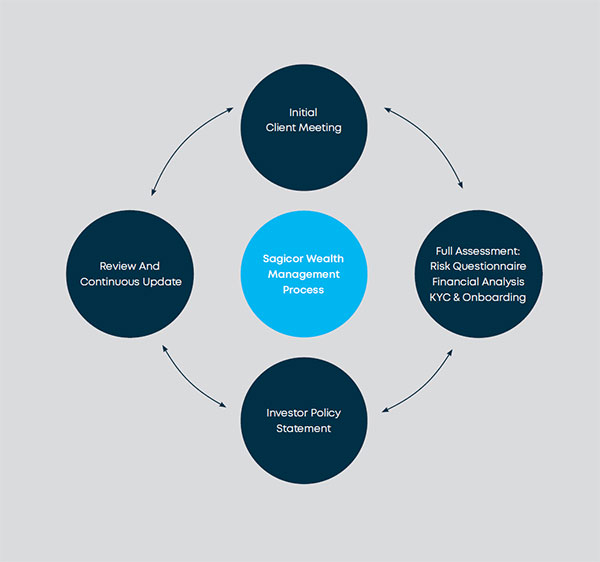

Sagicor Wealth Management involves a wholistic approach towards wealth accumulation and generation on an individual client basis through the establishment of bespoke portfolios to meet specified client objectives.

This revolving process is centered around the client and involves a multilayered structured process, which hinges on a comprehensive understanding of the client’s total

wealth, desired return objectives and risk tolerance. Once the gap analysis is completed, our wealth managers and investment specialists establish the wealth plan, which serves at the road map to closing the gap.

Our robust assessment includes the determination of the client’s ability and willingness to take the optimal level of risk, the client’s current financial circumstances, any liquidity needs, tax considerations and client’s stage in the investor lifecycle. The product of the thorough assessment is the establishment of a properly defined Investment Policy Statement, which guides the portfolio construction. Ongoing periodic reviews ensure that the investment process is up-to-date and serves to keep the investment portfolio on target to achieving the desired long-term results.

Meet the Wealth Management Team

Dexter Moe - Vice President, Investment Management Services

Mr. Dexter Moe joined Sagicor in 1997 and brings over twenty years of investment management experience to his role of Vice President, Investment Management Services at Sagicor Asset Management Inc. In this position, he is responsible for developing and implementing the investment management strategy for life insurance, pension and asset management portfolios.

Mr. Dexter Moe joined Sagicor in 1997 and brings over twenty years of investment management experience to his role of Vice President, Investment Management Services at Sagicor Asset Management Inc. In this position, he is responsible for developing and implementing the investment management strategy for life insurance, pension and asset management portfolios.

Mr. Moe and the team at Sagicor Asset Management are strongly committed to providing a wide range of investment solutions for individual investors as well as local, regional and international institutions.

Dexter is a member of the Management Investment Committee (MIC) and has served as Chairman of the Asset Liability Management Committee (ALCO). Dexter represents Sagicor as an executive member of a number of joint venture committees and has participated in several investment forums.

Dexter has a B.Sc. (Hons.) in Accounting from the University of the West Indies and an MBA (International Business and Finance) from Schulich School of Business, York University, Toronto, Canada. He holds the Chartered Financial Analyst (CFA) designation and is an Associate of The Chartered Governance Institute of Canada.

Michael Millar - Head of Wealth Management

The Sagicor Wealth Management department is ably led by Mr. Michael Millar, B.Sc. (Hons.), MSc, CFA, CAIA. Michael is an experienced finance and investments professional with an extensive career, education and training in investment management. Michael was employed by Sagicor Asset Management Inc. for over ten years and served in the post of Assistant Vice President, Investments where he worked intimately with management of pension investment services across Barbados and Eastern Caribbean along with the implementation of a number of strategic initiatives.

The Sagicor Wealth Management department is ably led by Mr. Michael Millar, B.Sc. (Hons.), MSc, CFA, CAIA. Michael is an experienced finance and investments professional with an extensive career, education and training in investment management. Michael was employed by Sagicor Asset Management Inc. for over ten years and served in the post of Assistant Vice President, Investments where he worked intimately with management of pension investment services across Barbados and Eastern Caribbean along with the implementation of a number of strategic initiatives.

Michael is currently a Chartered Financial Analyst (CFA) Charterholder. The CFA Charter is globally recognised as the “Gold Standard” in investment analysis. He remains committed to continuous education and in November 2020 obtained the Chartered Alternative Investment Analyst (CAIA) designation, which is also regarded as the highest standard in the area of alternative investments. As a prerequisite for obtaining the Investment Adviser License in the Organisation of Eastern Caribbean States, Michael successfully completed the 20th Eastern Caribbean Securities Market Certificate Program in 2019.

Samantha Johnson - Senior Wealth Officer

Samantha joined the Sagicor Wealth Management department in October 2021, having previously worked in Asset Management at CIBC FirstCaribbean Bank for 7 years where she was responsible for managing a portfolio of corporate and individual clients valued at approximately USD$50M. Prior to that, she worked as an Accountant at another financial institution for 18 years. During the 25 years before joining the Sagicor team, she also held the position of Broker/Trader on the Barbados Stock Exchange where she gained a wealth of experience in investment trading and management.

Samantha joined the Sagicor Wealth Management department in October 2021, having previously worked in Asset Management at CIBC FirstCaribbean Bank for 7 years where she was responsible for managing a portfolio of corporate and individual clients valued at approximately USD$50M. Prior to that, she worked as an Accountant at another financial institution for 18 years. During the 25 years before joining the Sagicor team, she also held the position of Broker/Trader on the Barbados Stock Exchange where she gained a wealth of experience in investment trading and management.

Samantha holds a B.Sc. in Accounting from the University of the West Indies and successfully completed the 8th Eastern Caribbean Securities Market Certificate Program in 2005.

Our Process: Simple and Client Focused

Mr. Dexter Moe joined Sagicor in 1997 and brings over twenty years of investment management experience to his role of Vice President, Investment Management Services at Sagicor Asset Management Inc. In this position, he is responsible for developing and implementing the investment management strategy for life insurance, pension and asset management portfolios.

Mr. Dexter Moe joined Sagicor in 1997 and brings over twenty years of investment management experience to his role of Vice President, Investment Management Services at Sagicor Asset Management Inc. In this position, he is responsible for developing and implementing the investment management strategy for life insurance, pension and asset management portfolios. The Sagicor Wealth Management department is ably led by Mr. Michael Millar, B.Sc. (Hons.), MSc, CFA, CAIA. Michael is an experienced finance and investments professional with an extensive career, education and training in investment management. Michael was employed by Sagicor Asset Management Inc. for over ten years and served in the post of Assistant Vice President, Investments where he worked intimately with management of pension investment services across Barbados and Eastern Caribbean along with the implementation of a number of strategic initiatives.

The Sagicor Wealth Management department is ably led by Mr. Michael Millar, B.Sc. (Hons.), MSc, CFA, CAIA. Michael is an experienced finance and investments professional with an extensive career, education and training in investment management. Michael was employed by Sagicor Asset Management Inc. for over ten years and served in the post of Assistant Vice President, Investments where he worked intimately with management of pension investment services across Barbados and Eastern Caribbean along with the implementation of a number of strategic initiatives. Samantha joined the Sagicor Wealth Management department in October 2021, having previously worked in Asset Management at CIBC FirstCaribbean Bank for 7 years where she was responsible for managing a portfolio of corporate and individual clients valued at approximately USD$50M. Prior to that, she worked as an Accountant at another financial institution for 18 years. During the 25 years before joining the Sagicor team, she also held the position of Broker/Trader on the Barbados Stock Exchange where she gained a wealth of experience in investment trading and management.

Samantha joined the Sagicor Wealth Management department in October 2021, having previously worked in Asset Management at CIBC FirstCaribbean Bank for 7 years where she was responsible for managing a portfolio of corporate and individual clients valued at approximately USD$50M. Prior to that, she worked as an Accountant at another financial institution for 18 years. During the 25 years before joining the Sagicor team, she also held the position of Broker/Trader on the Barbados Stock Exchange where she gained a wealth of experience in investment trading and management.