The Importance of Mutual Funds and Building a Strong Financial Foundation

By Nicholas Neckles

Portfolio Manager, Sagicor Asset Management Inc (SAMI)

Why Mutual Funds?

In today's financial landscape, preparing for one's future is not just a luxury; it's a necessity. One effective investment vehicle for building a resilient financial foundation is mutual funds. Here's a deep dive into why mutual funds are essential and how they can help in crafting a robust financial future, especially if you are planning for a major purchase or planning for retirement.

The Power of Capital Appreciation

When you invest in mutual funds, your money has the potential to grow over time, thanks to investment asset appreciation. Simply put, the share prices of profitable companies the mutual fund invests in increases.

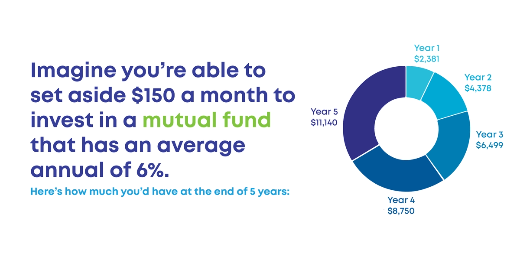

Investing the initial one-time minimum amount of $500 and subsequently $150 a Month for 5 years.

Imagine you're able to set aside $150 a month to invest in a mutual fund that has an average annual return of 6%. Here's how much you'd have at the end of 5 years:

After 5 years, you would have over $11,000, which can serve as a down payment on a significant purchase. Note that this assumes a 6% return, which is not guaranteed but is a reasonable estimate based on historical performance.

Building a Strong Financial Foundation

Financial stability is the cornerstone of a worry-free future. Mutual funds play a pivotal role in that, by serving as a safety net, whether you're aiming to buy a house, fund your child's education, or retire comfortably.

Mutual funds aren't just an investment option; they're a pathway to financial freedom and security. By incorporating them into your financial strategy, you can build a strong foundation that not only safeguards your present but also your future.

Visit: https://www.sagicor.com/en-BB/Personal-Solutions/Investment