A Lifetime of Good Planning

BY The Sagicor Advisor

Posted January 10, 2019

In retirement

Your retirement plan should adapt to your life as it changes. For example, as your standard of living increases, you might want to save more to protect the lifestyle you’ve built. In addition, you will find that tax rules change over time and that new financial instruments will come on line that might work for you.

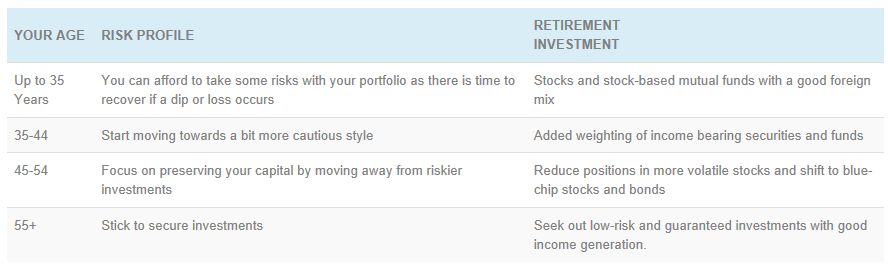

TIP: Adjust the risk exposure of your retirement investment portfolio as time goes by.

RETIREMENT PLANNING IS ABOUT MORE THAN MONEY

Your plan for retirement should cover more than just your financial well-being. As you get closer to retirement consider all aspects of your life and discuss your goals openly with your spouse, your family and your friends. For example: Do you foresee moving from your home, staying-put or moving to a retirement community? Do you have family elsewhere with whom you might want to make extended stays? Have you made arrangements for your health care and are your estate and Will in good order? (Please see our Guide to Estate Planning for more information on these topics).

HOW YOUR SAGICOR ADVISOR CAN HELP

This guide raises questions that your Sagicor Advisor can help you answer by taking you through all here steps of knowing where you are, determining where you are going and planning how to get there. After an initial retirement planning phase, in which your Sagicor Advisor helps out your plan into place with the right investments and annuities, they will play a vital role in helping you revisit and revise your plan as your circumstances change.

HOW YOUR SAGICOR ADVISOR CAN HELP

This guide raises questions that your Sagicor Advisor can help you answer by taking you through all here steps of knowing where you are, determining where you are going and planning how to get there. After an initial retirement planning phase, in which your Sagicor Advisor helps out your plan into place with the right investments and annuities, they will play a vital role in helping you revisit and revise your plan as your circumstances change.